Hello hello everyone! Welcome to another income report! Well, sort of. Grab a cup of coffee because it’s been a while and this is going to be very long.

FREE guide

Learn how I got 300 leads in a day with referral partners.

This free guide details the 8 step process I used to build a network of referral partners that have sent me up to 300 leads in a day.

We have to switch things up around here and start doing sales reports instead of income reports. This is a combination of sales from coaching, online programs, and brand partnerships. There are a few reasons for this change which I’m detailing below.

First change – We switched to an S-Corp for tax purposes.

My income increased dramatically last year because I doubled revenue and profits. Which meant I was getting creamed in taxes. I also noticed I was getting creamed in paying out contractors. So, some things had to change.

I had a meeting with my accountant back in November and we decided two things. First, I need to start hiring full-time help. Second, we need to switch the company to an S-Corp. This means we now have payroll so no more taking random draws from the business account to my personal account.

This also means…

Second change – I have an actual paycheck!

Long story short, I now get a paycheck from my company each month so my income is steady. This, in and of itself, is a really big deal to me. It feels really good to be able to give myself an actual paycheck every two weeks from a company that I built from scratch!

I’ve been dealing with variable income for years. so it feels good to know that every two weeks I get a paycheck that I can then use to manage money. And my taxes are being taken out of my check, so no more having to deal with estimated taxes every quarter!

And, since I recently had to move out of my apartment on short notice and am back home, I’m saving half my paycheck! I don’t exactly know what I’m going to do with the money or where I’m going, so, for now, I’m just hanging out and stacking cash. When the right investment or move comes to me, I’ll know.

That also means we’re switching focus and focusing on sales and receivables moving forward. In other words, what have we closed in new deals? What money is coming in? What deals are on the table? Because in my mind, payroll is now a business expense.

The transition from freelancer/sole proprietor to a business owner

One of the students in Persuade to Profit recently mentioned how she found Robert Kiyosaki’s Cash Flow Quadrant and was curious about it. This is basically the image Robert Kiyosaki uses to explain how to get rich and which means are the most suitable for building wealth.

It goes a little something like this:

Employed: You work for someone else. Trading time for dollars.

Self-Employed: Could be a doctor or lawyer or a freelancer.

Business Owner: You own some sort of a system

Investor: Your money works for you. As Grant Cardone says, “Your money makes babies.”

Most of the population gets stuck at “E” and “S” when our goals should be to get to “B” and “I.” Why? Because you build more passive streams of income. You also get better tax breaks.

I learned about this quadrant back in 2016 and thought to myself, “Okay, so clearly, I don’t want to be a self-employed freelancer forever. That’s better than working for someone else but it’s not where true freedom lies. I need to start making moves to become a business owner and investor.”

And that’s what I started to do. I started investing in creating systems – like Persuade to Profit – a couple of years ago. I also improved my sales skills. That’s how I doubled revenue and profits in a 12 month period.

Where I Am

Now, I’m not quite at business owner or investor yet, but I’m a hell of a lot closer than I was before. The next phase of this looks like scaling my company which I’ve begun to do (that in and of itself is a whole other process for a whole other series of blog posts).

I’ve also begun investing most of the money I’m now saving while I’m home. Granted, I’ve been investing in IRAs and index funds for years, but after taking a class about trading stocks and options, I learned I would actually prefer real estate. I invested in a real estate fund back in December and I started receiving my dividends in March. It was pretty sweet to see that money starting to come in, even though right now it’s just baby money.

Now that I understand this better, I’ve even begun telling my own clients – “Listen, guys, we’re going to start focusing on real money. I want to help you build something that will take care of you for the rest of your life.”

So these are the biggest changes over the last few months as I make the transition from self-employed to business owner and investor.

Does it happen overnight? Absolutely not. But I’m happy to see tremendous progress.

And speaking of progress, now let’s get to what you’ve been waiting for – the sales report!

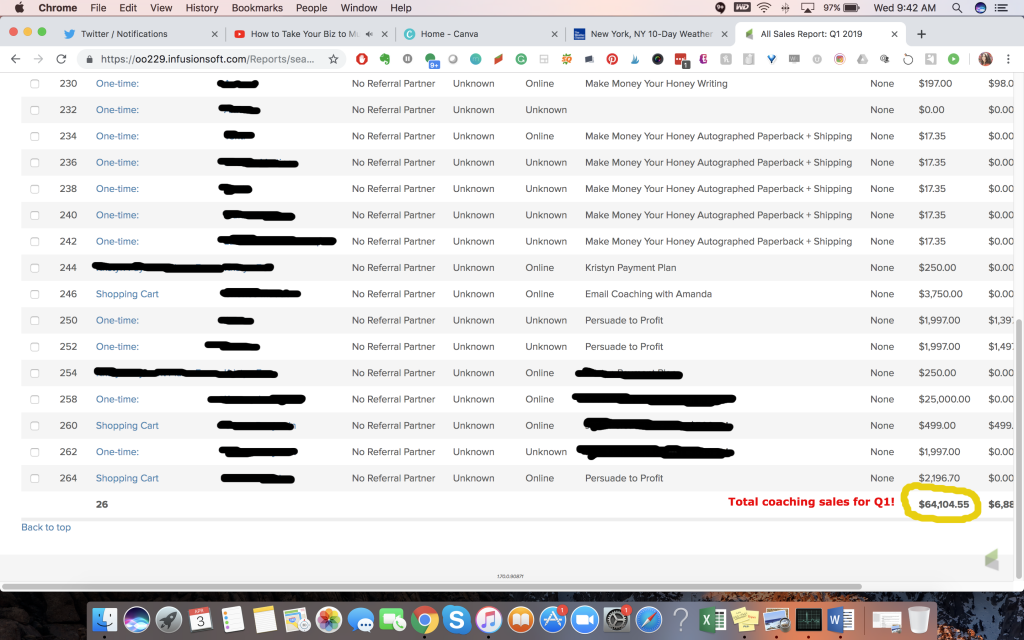

Grant Total for 2019 Q1 Sales Report: $106,104.55

Ahhhhh!!!!!!

You guys, this is more than half of what my company grossed in all of 2018 and we did it in THREE MONTHS! This was also amid a whole ton of craziness including international travel, 10X GrowthCon, traveling for clients, hiring people, firing people, administrative changes, having a life and moving.

Here’s the breakdown:

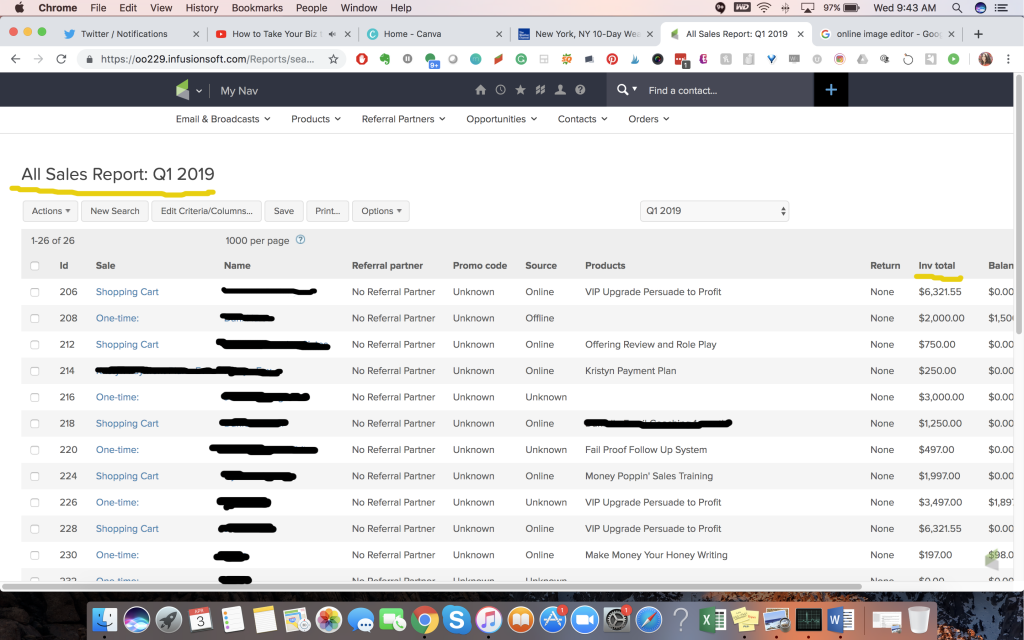

Coaching and coaching programs: $64,104.55 (screenshots below)

Working with brands: $42,000

(Can’t show the contracts otherwise I would)

How the hell did I do this after struggling for so many years?

I’ve had some really big AHAs in the last couple of years. Bear with me as I go through them.

AHA #1: Most traditional personal finance advice is ridiculously outdated and focuses on lack of money.

I did the whole managing money/not buying a coffee thing for way too long. It’s kind of bullshit. The reason is that it has you focusing on the wrong thing: the lack of money in the world. Instead, we should be focusing on the sheer abundance of money and opportunity in the world and learn how to get some of it for ourselves.

I understand most of the population is still trying to wrap their heads around what even happens to their money every month so we start with the basics, but at some point, we’re doing people a disservice. It’s like we’re only telling them half the story of what it takes to build wealth.

AHA #2: Commitment to your success requires an investment of time AND money.

I invested around $70k back into the business last year. And I personally invested about $15k in my own personal development. I’m now starting to see the ROI from both.

So yes, I walk my talk, people. And I put my money where my mouth is.

AHA #3: I started investing in full-time help.

Hiring a full-time assistant has been amazing! While it’s taken a few months to really get her trained, having full-time support that is local to me has been very helpful. I’m now starting to get everything that has been in my brain all these years and pouring it into the minds of people within my company. This will help me scale the company to new heights as well as allow me to keep my focus on what matters instead of doing way too much myself.

Not to mention, it’s helpful to have someone else enforcing your boundaries for you. Now clients are asking Zenya questions instead of always coming to me. She’s become a part of the company and the brand so I no longer feel like I’m carrying it all by myself.

I also started investing in some other things just to save time and keep me focused. For example, I’m doing the CateredFit meal delivery service which means I don’t have to worry about cooking food unless I want to actually cook. It’s a small investment that goes a long way.

AHA #4: My original goals weren’t big enough

I was recently on my Instagram stories talking about something I don’t see the financial or entrepreneurial community talk about very often:

The depression that sets in after you meet a goal because a) you realize it didn’t have to be such a damn struggle and b) you’re bored.

I actually got a little depressed and anxious after I crossed the six-figure mark for the first time. Don’t get me wrong, I was psyched that I finally did it! But, the feeling didn’t last very long.

Within a few weeks, I found myself kind of lost. I felt like I no longer had direction or purpose.

I was also kind of pissed off. Quite frankly. $100,000 in a year isn’t that much money. Between taxes and expenses, it’s really not much at all.

And that’s when I finally understood why so many of the greatest entrepreneurs keep telling people to set bigger goals.

First, because you need more money than you think you do.

Second, because you’ll get bored and start backsliding.

Third, when you have no direction or focus you are susceptible to lack of motivation and shiny object syndrome.

And finally, because it’s not really about money. It’s about reaching your own potential.

So I set bigger goals for myself.

Not because I’m greedy and want more money, but because I know I’m capable of so much more. And there’s a lot of people out there who need the message I’m sharing.